Hindsight Is 20/20: Famous Ponzi Schemes and Why They Weren’t Obvious

Throughout history, promises of high returns and low risk have lured investors to financial peril

If they only used their brilliance for good and not evil, what a better world we all might live in. Unfortunately, the brilliant businessmen behind some of the most famous Ponzi schemes, both in the past and more recently, chose to use their intelligence to prey upon all of society—from the poor elderly to the rich and famous.

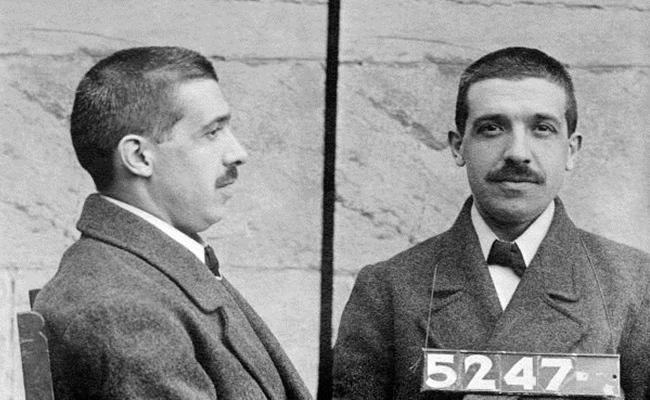

The Man Who Started It All: Charles Ponzi

In the post World War One era, Charles Ponzi became a millionaire in just six months. How did he do it? He made promises of 50% returns in just 45 days or 100% returns in 90 days to investors willing to give him their money for international postal coupons. He hired agents to collect investor money and used the new investment dollars to pay off only some of the old investors, to keep the scheme alive. He managed to keep it going to the tune of almost $20 million before federal authorities caught and imprisoned him.

Modern Day Mastermind: Bernie Madoff

Promising investors a long-term way to beat the market is how Bernie Madoff stole $65 billion from investors over a 50-year period. Rather than promising outrageous short-term profits, his long-term plan made it seem more legitimate to investors over time. While his wealth management business was initially a legitimate New York business, it ultimately became the Ponzi scheme responsible for the largest fraud in US history. Madoff received the maximum sentence of 150 years after being turned in to authorities by his own sons.

Flashy Florida Personality: Scott Rothstein

Owning over 100 luxury watches, opulent yachts, state-of-the-art planes, Ferraris and a pair of Bugattis, surrounded by armed bodyguards and police protection, Scott Rothstein lived quite an extravagant lifestyle. While Rothstein claims the flashiness was just a persona, he drew in celebrities and politicians alike, intoxicating investors with claims of 20% returns in just 3 months. Investors were actually investing their money into fabricated structured settlements in Rothstein’s $1.4 billion Ponzi scheme, the largest in Florida’s history. Now serving a 50-year sentence in an undisclosed prison, Rothstein is currently angling for a sentence reduction by implicating others involved in his scheme.

Music Man Turned Con Man: Lou Pearlman

As one of the hottest music producers in the 90’s, Lou Pearlman also produced one of the longest-running Ponzi schemes in US history. While promoting popular boy bands like ‘NSYNC and the Backstreet Boys, Pearlman lured individuals and corporations into investing in two companies that he completely fabricated—they existed only on paper. Not only did he fake the companies, he also faked financial statements to secure bank loans. After 20 years and stealing more than $300 million from investors, Pearlman was sentenced to 25 years in prison.

Why weren’t these Ponzi schemes obvious to investors?

Perhaps it is because they promised big, fast returns and appealed to the American desire to get rich quick. Perhaps the brilliance of their creative, audacious, spellbinding minds and characters blinded people to the truth. Or, perhaps it is because investors wanted to believe that they could have a bigger piece of the pie if they jumped on board. Unfortunately, that was not the case for the tens of thousands of investors who were affected by these Ponzi schemes over the years.

Suffice it to say, beware of promises of high returns and low risk made to you by any broker, financial adviser or investment firm. High returns come with high risk – that’s just the way it is. If something seems too good to be true, it probably is.

When investors have suffered losses due to the misconduct of a financial advisor or brokerage firm, their only avenue to loss recovery is through securities arbitration. Silver Law Group is a nationally recognized securities arbitration law firm representing investors worldwide. Our attorneys have recovered millions of dollars for investors in Ponzi schemes including several of the ones described here. We work on a contingency fee basis to recover investment losses caused by broker misconduct. Contact us today for details or to have your case evaluated by one of our experienced securities arbitration attorneys.

Securities Arbitration Lawyers Blog

Securities Arbitration Lawyers Blog