Silver Law Group Investigating AllianceBernstein Energy Opportunity Funds

Silver Law Group, a nationally-recognized class action law firm, is investigating AllianceBernstein Energy Opportunity Fund, L.P. and AllianceBernstein Energy Opportunity Fund, L.P II (collectively “AB Energy Funds”) on behalf of shareholders in the company.

Silver Law Group, a nationally-recognized class action law firm, is investigating AllianceBernstein Energy Opportunity Fund, L.P. and AllianceBernstein Energy Opportunity Fund, L.P II (collectively “AB Energy Funds”) on behalf of shareholders in the company.

The AB Energy Funds are pooled investment private equity funds, focused in the oil and gas industry, sold by AllianceBernstein. According to Alliance Bernstein, the AB Energy Funds’ “. . . investment objective and strategies are to generate attractive risk-adjusted returns, through current income and capital gains, by capitalizing on private and public debt and equity investment opportunities in North American oil and gas producers.” Continue reading ›

Securities Arbitration Lawyers Blog

Securities Arbitration Lawyers Blog

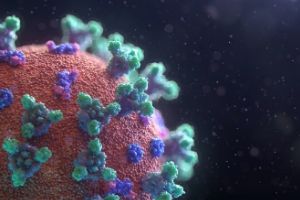

Silver Law Group is launching a Coronavirus Task Force to investigate financial wrongdoing associated with the coronavirus (COVID-19) pandemic, including wrongfully denied business interruption insurance. Silver Law Group is working with lawyers with significant experience handling wrongful denial of insurance claims. Working as a team, our lawyers have significant experience prosecuting claims against various financial services and insurance companies for misconduct.

Silver Law Group is launching a Coronavirus Task Force to investigate financial wrongdoing associated with the coronavirus (COVID-19) pandemic, including wrongfully denied business interruption insurance. Silver Law Group is working with lawyers with significant experience handling wrongful denial of insurance claims. Working as a team, our lawyers have significant experience prosecuting claims against various financial services and insurance companies for misconduct. Silver Law Group, a nationally-recognized

Silver Law Group, a nationally-recognized  Background Information

Background Information  Silver Law Group is investigating the following

Silver Law Group is investigating the following  As the coronavirus has caused the market to decline precipitously starting in February, 2020, many leveraged exchange-traded funds (ETFs), inverse ETFs, and exchange-traded notes (ETNs) have stopped trading, causing massive losses for investors.

As the coronavirus has caused the market to decline precipitously starting in February, 2020, many leveraged exchange-traded funds (ETFs), inverse ETFs, and exchange-traded notes (ETNs) have stopped trading, causing massive losses for investors. Silver Law Group has filed a FINRA dispute resolution claim against Wells Fargo and one of its brokers on behalf of a client who lost over $1,000,000 as a result of bad real estate investment advice he received from his broker.

Silver Law Group has filed a FINRA dispute resolution claim against Wells Fargo and one of its brokers on behalf of a client who lost over $1,000,000 as a result of bad real estate investment advice he received from his broker.